Circular Flow of Income

Circular Flow of Income

Level: AS Levels, A Level, GCSE – Exam Boards: Edexcel, AQA, OCR, WJEC, IB, Eduqas – Economics Revision Notes

National Income

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit.

Examples of assets:

- House

- Car

- Stocks and shares.

Wealth is a stock of assets owned by an individual, corporation or country – it normally refers to the amount they own.

Income refers to the flow of money – for e.g. wages

As wealth increases in value, the consumer’s confidence may increase, encouraging them to spend more money. This highlights the positive correlation between wealth and income. Collateral describes assets being used as a security for a loan. The consumer is likely to receive a loan from the bank if they want to purchase a new asset.

Circular Flow of Income

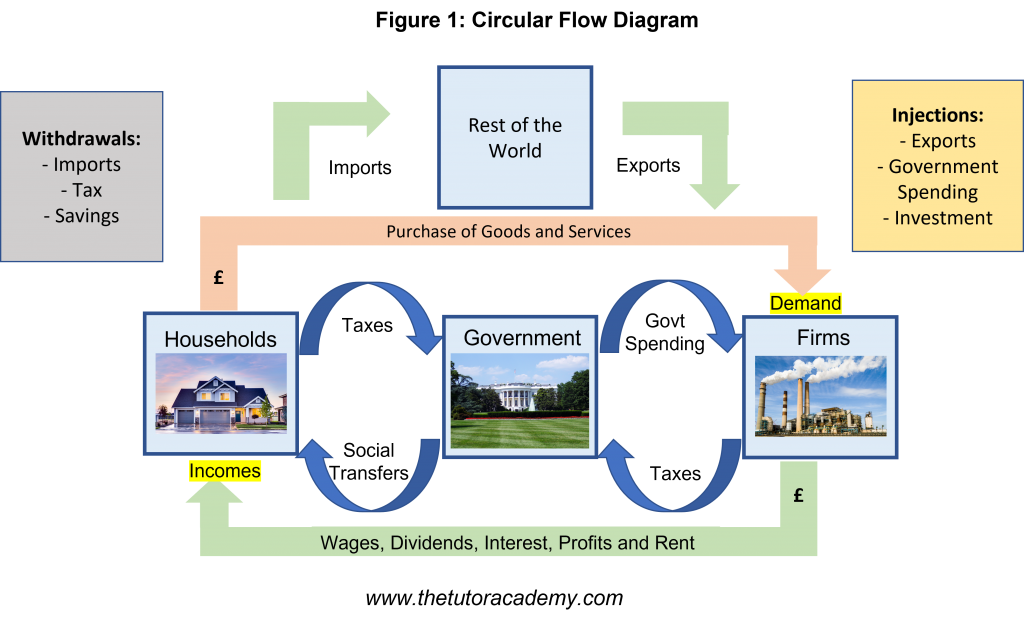

Injection

- This is money spent into the circular flow of income and therefore the economy. This contributes to a positive multiplier effect.

Investment – an increase in assets or capital

Government Spending – this is spending made by the government e.g. NHS, defence, education and infrastructure

Exports – goods and services from the UK being bought by people in other countries

Withdrawals

- Leakages out of the circular flow of income. This is money not being spent in the economy and contributes towards a negative multiplier effect.

Imports – these are goods and services bought by people from the UK from abroad.

Savings – this is money that is not being spent in the economy but instead being saved and therefore does not contribute to the multiplier.

Taxes – taxation by the government leaves consumers with less disposable income to spend in the economy.

Analysis of how the Circular flow of income works

- Households purchase goods and services from firms.

- Firms pay wages, dividends, profits and rent to households as income.

- Firms pay taxes to governments who pay these to households through social transfers.

- Households pay taxes to governments e.g. income tax

- Governments purchases items from firms e.g. NHS equipment

Imports & Exports

- Imports are purchased from the rest of the world as withdrawals from the domestic circular flow of income

- Exports purchased from the UK from other countries are seen as injections into the domestic circular flow of income.

Savings & Investments

- Households save money in banks (Withdrawals) which then reinvest into the economy as an Investments (Injections)

- Businesses invest into the economy normally through firms as injections.

Quick Fire Questions – Knowledge Check

- Define ‘asset’ (2 marks)

- Identify three examples of an asset (2 marks)

- Define wealth (2 marks)

- Explain the relationship between wealth and income (3 marks)

- Define ‘injection’ and explain the three injections into the circular flow of income (6 marks)

- Define ‘withdrawal’ and explain the three withdrawals into the circular flow of income (6 marks)

- Explain how the Circular Flow of Income works (6 marks)

- Explain how imports and exports impact the Circular Flow of Income (4 marks)

- Explain how savings and investments impact the Circular Flow of Income (4 marks)

Next Revision Topics

- Economic Growth

- Aggregate Demand

- Exports / Imports

- The Multiplier

- Equilibrium levels of real national output

- Gross National Income

A Level Economics Past Papers