Aggregate Demand (AD)

Aggregate Demand (AD)

Level: AS Levels, A Level, GCSE – Exam Boards: Edexcel, AQA, OCR, WJEC, IB, Eduqas – Economics Revision Notes

Aggregate Demand (AD)

Definition

Aggregate Demand (AD) is the total demand for goods and services within an economy.

Aggregate Demand – Formula:

AD = C + I + G + (X – M)

C = Consumption (Around 60% of AD is consumption)

I = Investment

G = Government Spending

X = Exports

M = Imports

What impacts the components of AD?

What impacts Consumption?

Interest rates

An increase or decrease in interest rates can help to manipulate consumption in the U.K. economy.

Lower Interest Rates

A decrease in interest rates will make the cost of borrowing cheaper for consumers. This will provide them with an incentive to borrow and spend rather than save. This is because saving money when interests are low means the return you will get is lower.

Lower interest rates will also make it more attractive for businesses to borrow and invest in the U.K economy creating a positive multiplier.

Higher Interest Rates

High-interest rates will cause a decrease in consumption. Higher rates will encourage consumers to save as they will gain higher returns on their deposits causing a decrease in consumption.

Higher rates will also encourage businesses to invest less due to higher interest repayment costs.

Taxes

A decrease or increase in taxes will impact consumer’s disposable income. An increase in income tax would reduce consumption as consumers would be left with less disposable income to spend after tax.

Consumer confidence

When consumers feel more confident about the state of the economy e.g. boom period in the business cycle. They are more likely to spend money as their pay will also be higher. (Vice versa)

State of the economy

If a country isn’t in a good economic position due to high levels of corruption or civil war. This could negatively impact consumer confidence and lead to lower consumption.

Income

The more income consumers earn. The more they will consume.

Wealth effects

The wealthier a consumer feels the more they tend to spend. Wealth is normally determined by the assets or income an individual earns or holds. An increase in the value of assets such as a house or shares makes people feel wealthier and causes a large increase in consumption. A positive wealth effect causes an increase in consumer confidence and spending.

The distinction between a movement and shift in AD

Movement

A movement along the AD curve is caused due to change in prices

A rise in price levels will result in an upward movement along the AD curve

A fall in price levels will result in a downward movement along the AD curve

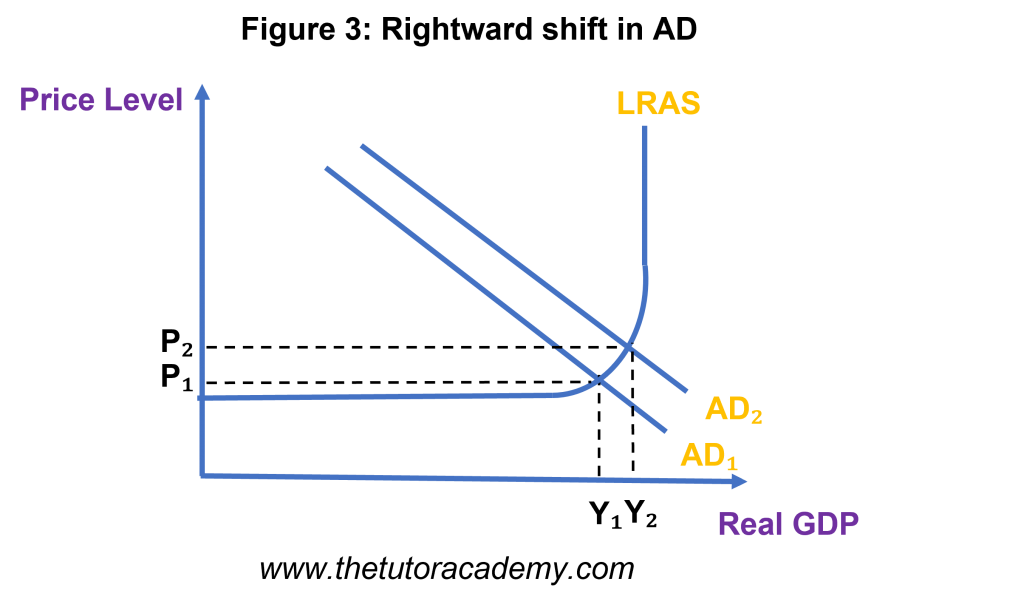

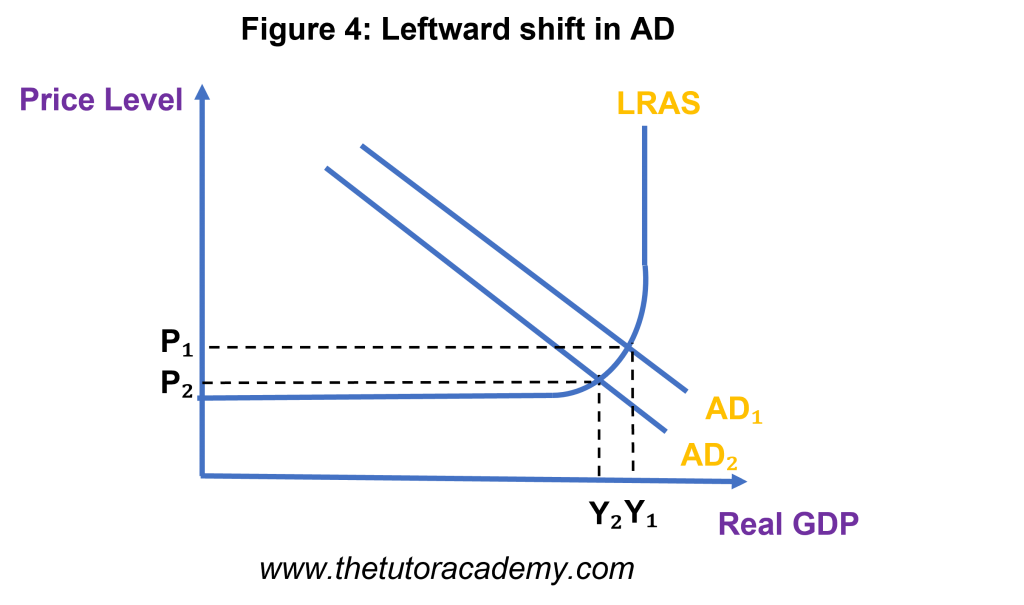

Shifts

A change in any other variable will cause a rightward or leftward shift in the AD curve

Why is the AD Curve downward sloping?

Income Effect

There will be a contraction in Aggregate Demand if price levels rise as people have lower incomes and can afford less

Substitution Effect

Aggregate Demand is likely to contract if price levels in the UK rise as consumers will buy goods from a different country for a cheaper price – hence imports will increase and exports will decrease

Interest Rate Effect

There will be a contraction in Aggregate Demand if price levels rise as firms will have to pay their workers more, causing the demand for money to increase. Higher interest rates suggests consumers will save more and spend less, so borrowing will fall and firms will invest less, meaning AD will contract

AQA Spec – Additional Content

The Accelerator Process

This process suggests that a change in a country’s GDP is reflected through a change in the level of investment

Investment will be higher with greater economic growth, however may fall if the economic growth is growing but at a slower pace

In comparison to the Economic Growth, the level of Investment is more volatile

Quick Fire Quiz – Knowledge Check

1. Define ‘Aggregate Demand’ (2 marks)

2. Identify the components of Aggregate Demand (4 marks)

3. Identify six factors which affect the level of consumption (6 marks)

3. Explain how a change in interest rates would affect the level of consumption (6 marks)

4. State the formula for Aggregate Demand (2 marks)

5. Explain the distinction between a movement and shift in Aggregate Demand (4 marks)

6. Explain why the AD curve is downward sloping (6 marks)

7. Using an ad/as diagram show how an increase in government spending on education and an increase on government spending on infrastructure affects long run aggregate supply and aggregate demand.

8. What economic scenario could lead to both long-run aggregate supply (LRAS) and aggregate demand (AD) shifting left, and what would be the expected impact on the economy in the long run?

9. How would an increase in consumers income impact the aggregate demand curve? use a diagram to show the impact.

10. If there was a depreciation in the UKs currency, how would aggregate demand be affected, show this using a diagram.

Next Revision Topics:

- Demand

- Economic Growth

- Government Spending

- Exports / Imports

- Employment & Unemployment

- Consumption

- Investment

A Level Economics Past Papers