Price Discrimination

Price Discrimination

Level: AS Levels, A Level, GCSE – Exam Boards: Edexcel, AQA, OCR, WJEC, IB, Eduqas – Economics Revision Notes

Price Discrimination

This is when firms are able to use their market power to charge consumers a higher price for the same good / service being provided.

Conditions necessary for Price Discrimination

- Price Maker – the firm engaging in price discrimination must be a Price Maker and should therefore possess a degree of market power

- Different Elasticities of Demand – there should also be different submarkets consisting of consumer groups with different price elasticities of demand

- Separate Markets – the cost of keeping markets separate should be less than the increased profit gained from doing so. Consumers must also be unable to move from one submarket to another

First Degree Price Discrimination

This occurs when a firm is able to charge the maximum price that consumers are willing to pay; hence resulting in no consumer surplus

Second Degree Price Discrimination

This occurs when consumers are charged different prices depending on the choices available to them. Some of these choice may include factors such as: quantity, time, positive customer loyalty.

Effectively, the consumers are in control of the price they pay as they pick the choice most preferable to them.

Third Degree Price Discrimination

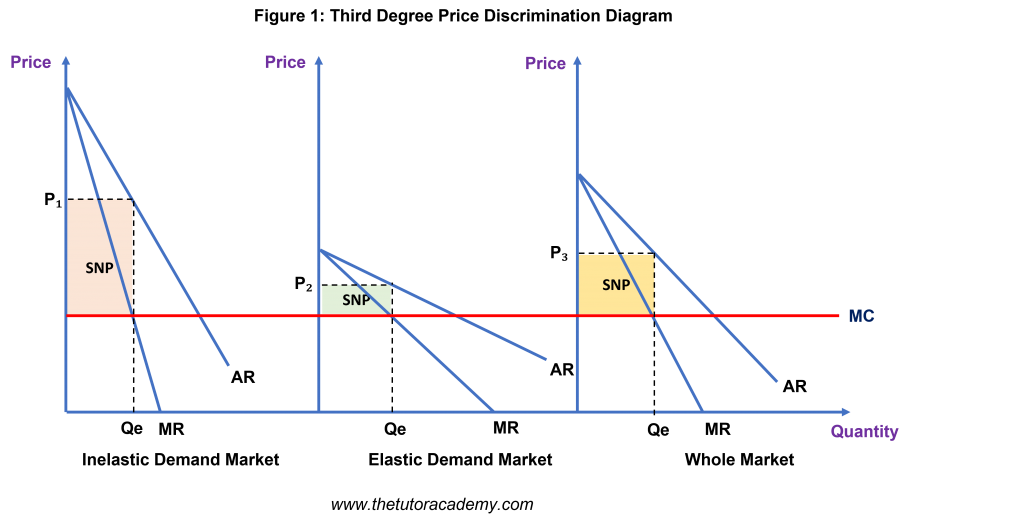

This occurs when different prices are charged to different consumer groups for the same good / service. Examples of this include: student discounts, peak & off-peak travel, cheaper prices depending on the time of day – ‘happy hours at pubs / bars’.

Firms engage in Third Degree Price Discrimination when their demand is price elastic. They are likely to charge consumers higher prices when their demand is price inelastic to increase their sales and revenue.

Equilibrium occurs when MC = MR.

We can see the price is higher in the inelastic demand market. Firms will charger prices as they know consumers will continue to purchase their goods / services.

Price is lower in an Elastic Demand Market as the demand for products will decrease if prices were to rise.

Profit is also much higher in the inelastic demand market than in the elastic demand market and for the firm.

Advantages of Price Discrimination

- If consumers receive a lower price, they can benefit from a net welfare gain

- Positive externalities can be yielded as consumers which were previously excluded from accessing the good / service due to high prices, can now benefit from it at a lower price

- Firms making supernormal profit can use this to invest into innovation, R&D, and better quality goods / services

- Spare capacity can be used in a more efficient manner

Disadvantages of Price Discrimination

- Usually, consumers will experience a loss of consumer surplus as they may be faced with higher prices in the long run if the monopoly power of firms strengthen

- Since P > MC, there will also be a loss of allocative efficiency

- There may be a divide in the market which could limit the benefits they gain

Quick Fire Quiz – Knowledge Check

1. Define ‘Price Discrimination’ (2 marks)

2. Identify and explain the three conditions necessary for Price Discrimination to occur (6 marks)

3. Explain when First Degree Price Discrimination occurs (2 marks)

4. Explain when Second Degree Price Discrimination occurs (2 marks)

5. Explain when Third Degree Price Discrimination occurs (4 marks)

6. Identify two examples of Third Degree Price Discrimination (2 marks)

7. Using diagrams, explain the differences in price, quantity and profit for an inelastic demand market and an elastic demand market (10 marks)

8. Explain why the profit generated is greater in the inelastic demand market. (4 marks)

Next Revision Topics

- Perfect Competition

- Monopolistic Competition

- Oligopoly

- Monopoly

- Natural Monopoly

- Monopsony

- Profit

- Costs

- Revenue

- Contestability

A Level Economics Past Papers